Automate your rate reconciliation

Stop reformatting spreadsheets. TAXASU gives you the reports and tax footnotes that meet ASU 2023-09 requirements. Integrate your tax provision data from an Excel model or provision software, get started now.

Stop reformatting spreadsheets. TAXASU gives you the reports and tax footnotes that meet ASU 2023-09 requirements. Integrate your tax provision data from an Excel model or provision software, get started now.

FASB ASU 2023-09 changes how business entities are required to disclose their income taxes in financial statements. TAXASU makes it easier for tax professionals.

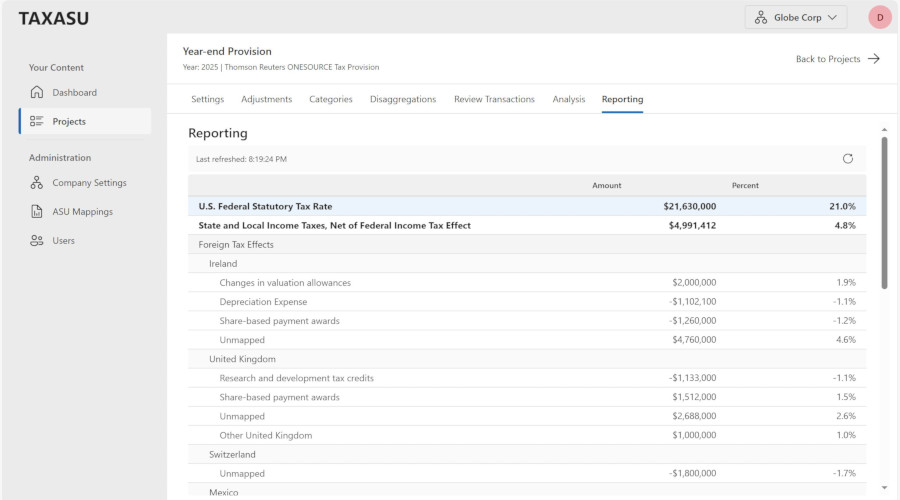

Import data from Excel or tax provision software like Corptax, ONESOURCE Tax Provision, Oracle TRC, or Longview.

Use analytics to review and verify if adjustments meet disclosure thresholds.

Map your tax adjustments to the required ASU categories and create custom disaggregations when detailed disclosure is required.

TAXASU's reporting engine produces an ASU 2023-09 compliant effective tax rate reconciliation.

Get answers to common questions about TAXASU and ASU 2023-09 compliance

In December 2023, the Financial Accounting Standards Board (FASB) released Accounting Standards Update 2023-09: Improvements to Income Tax Disclosures, which applies to all companies that follow U.S. GAAP. The updated standards go into effect in 2025 for most public business entities and 2026 for most non-public business entities.

The amended standards require business entities to disclose specific categories and provide additional information for reconciling items that meet a quantitative threshold. For the State and Local category, public business entities must provide a qualitative description of the states and local jurisdictions that make up the majority of the effect within this category.

For more information, read the complete guidance on the FASB website.

TAXASU is intended to work with the provision software you use. As long as you provide data in the required formats, TAXASU is compatible with: Excel workbooks, Thomson Reuters ONESOURCE Tax Provision, CSC Corptax Provision, Oracle TRC, and Longview.

Not completely. TAXASU offers a more customized and flexible approach to generating your rate reconciliation reports.

TAXASU is in limited release so that we can meet the demands of our users. This allows us to manage system load and ensure quality. If you are interested in using our solution to create your ASU 2023-09 rate reconciliation report, please use the Request Access form.